BSA GROUP Free US TARIFF calculators are based on standard assumptions and the figures you input. They give estimates only and are not meant to replace professional advice from a 3PL.

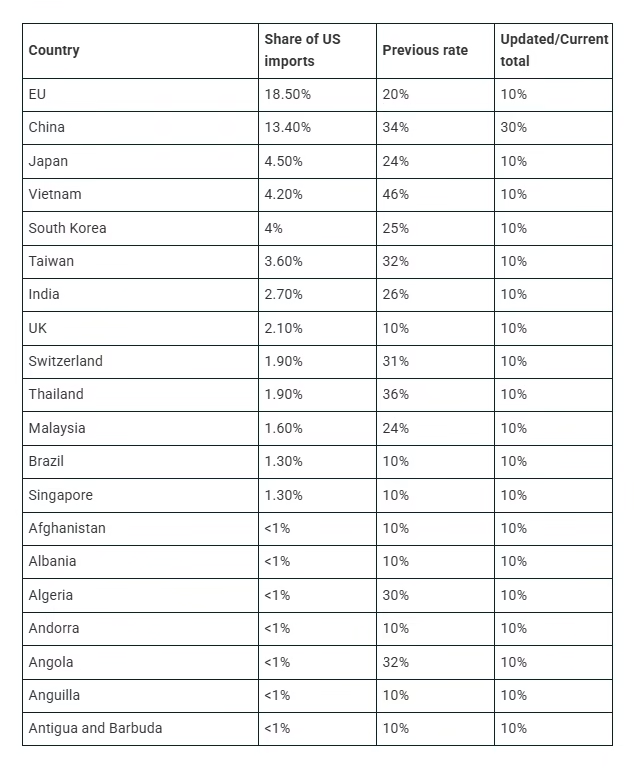

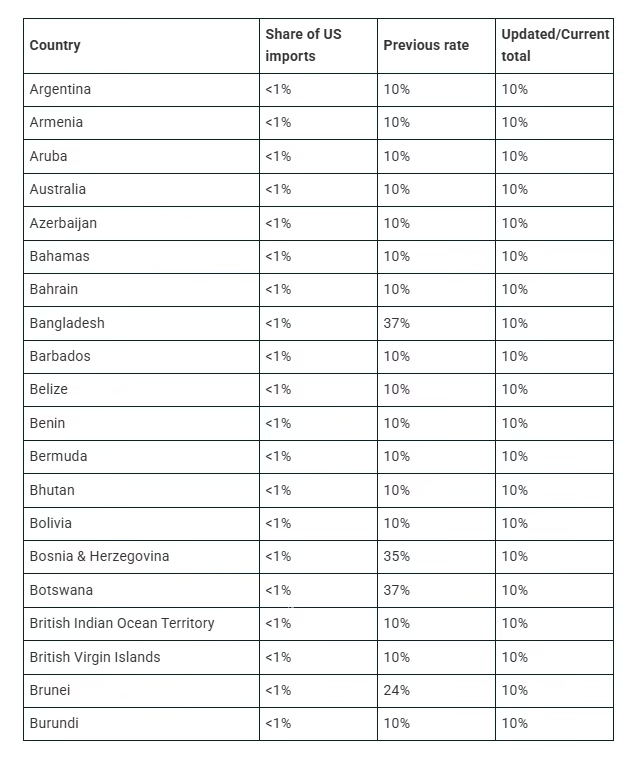

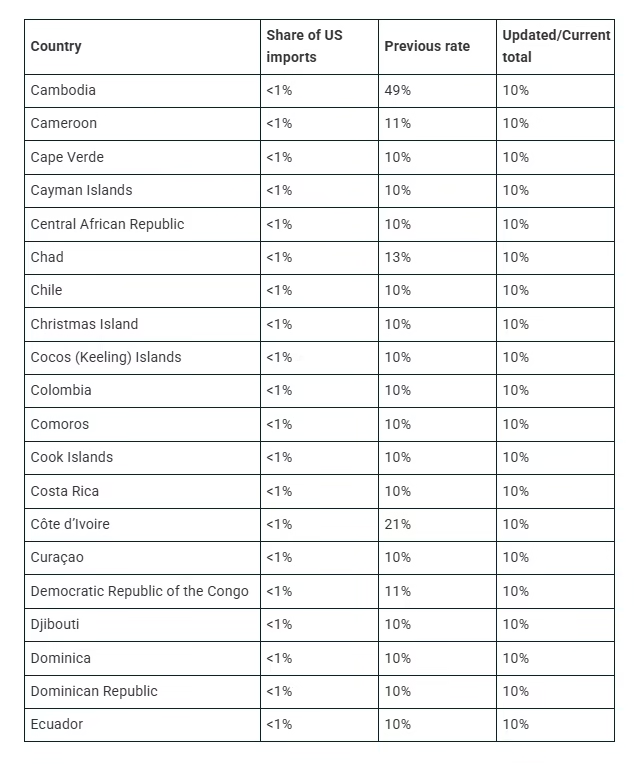

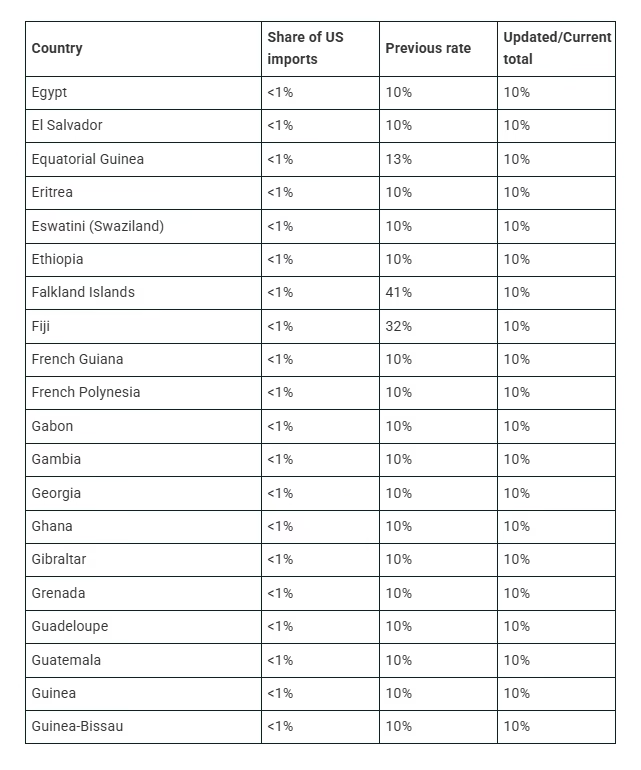

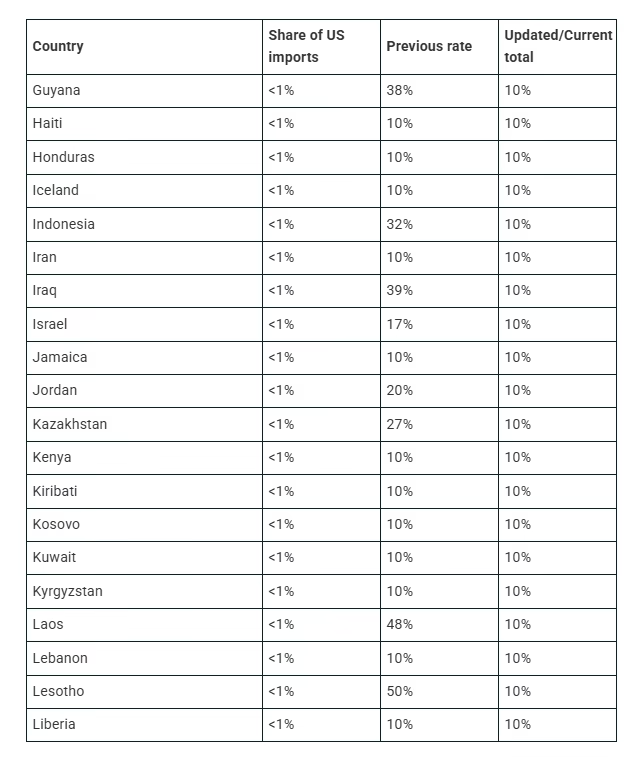

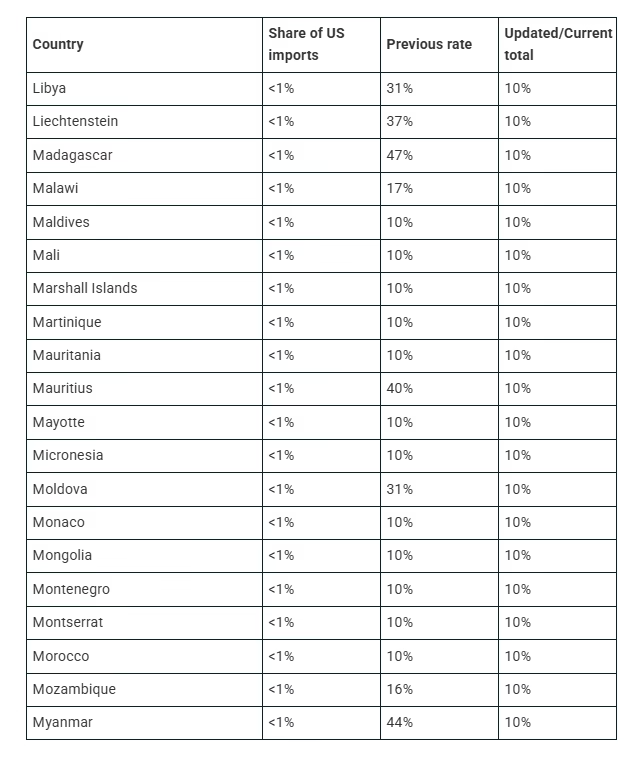

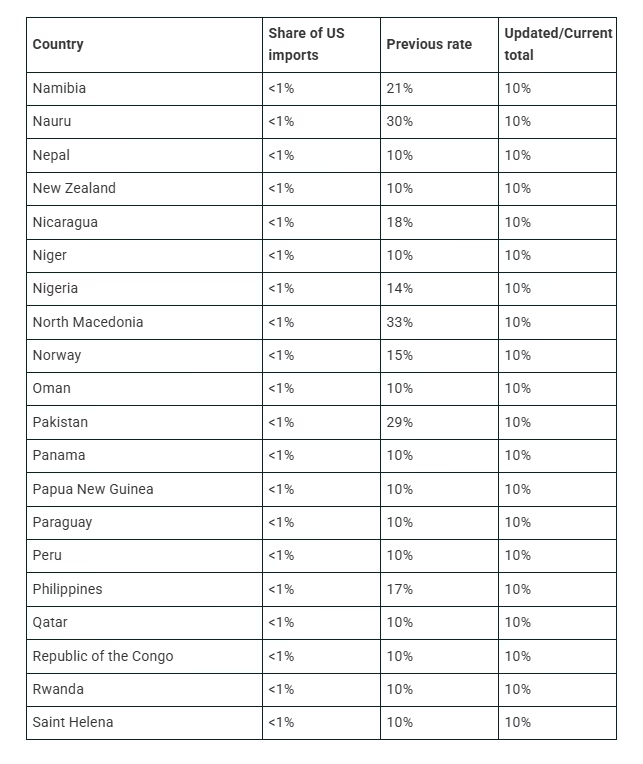

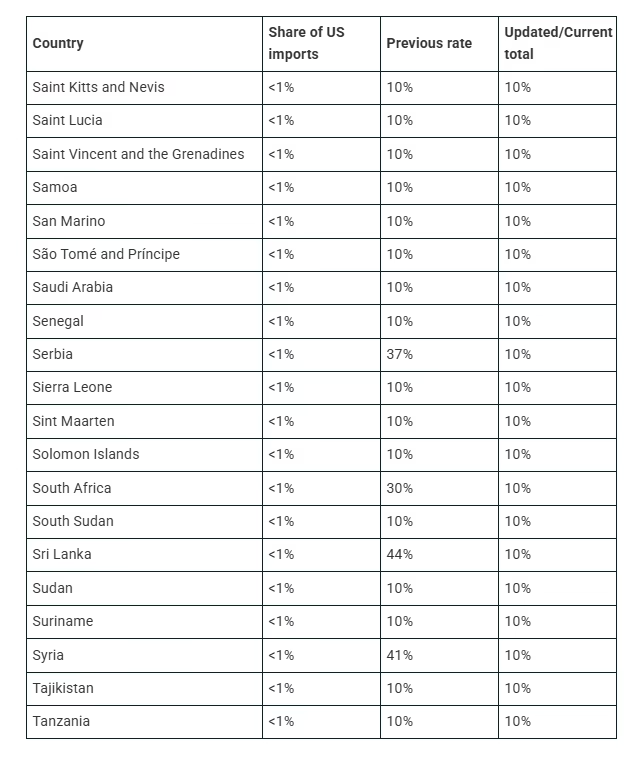

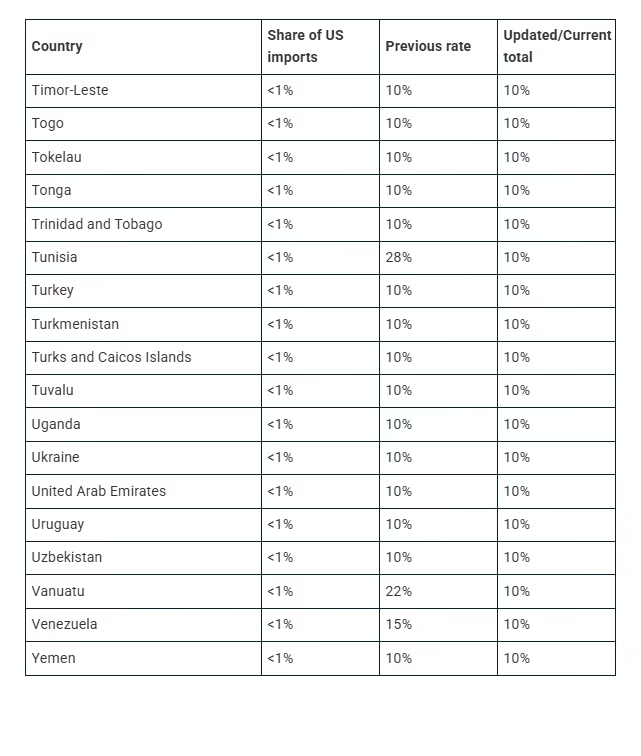

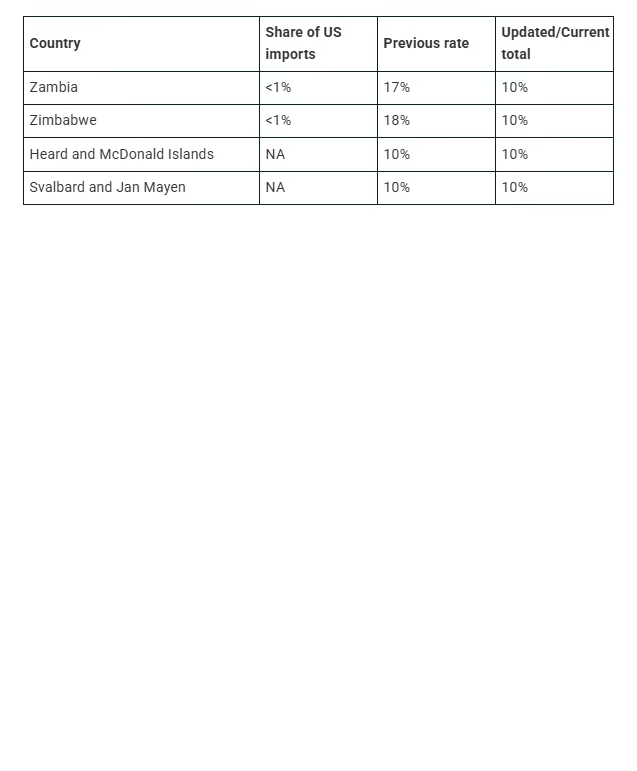

*Please note that the tariff values presented in this calculator are based on the most up-to-date and accurate tariff policy information available as of noon Central Daylight Time (CDT) on May 24th, 2025. At that time, the standard tariff rate of 10% was in effect for all countries except for the European Union (50% ~ June 1st, 2025), Canada (35% ~ August 1st, 2025), China (30% as per the latest statement from the Trump administration), and Mexico (25%).

Tariff policies are unpredictable and subject to change. The values provided by this calculator should be considered estimates for informational purposes only and may not reflect the actual tariffs in effect at the time of import. It is recommended to consult official government sources and customs authorities for the most current and accurate tariff rates.

Data Retrieved From Source: White House